Getting familiar with Medicare Advantage Plans

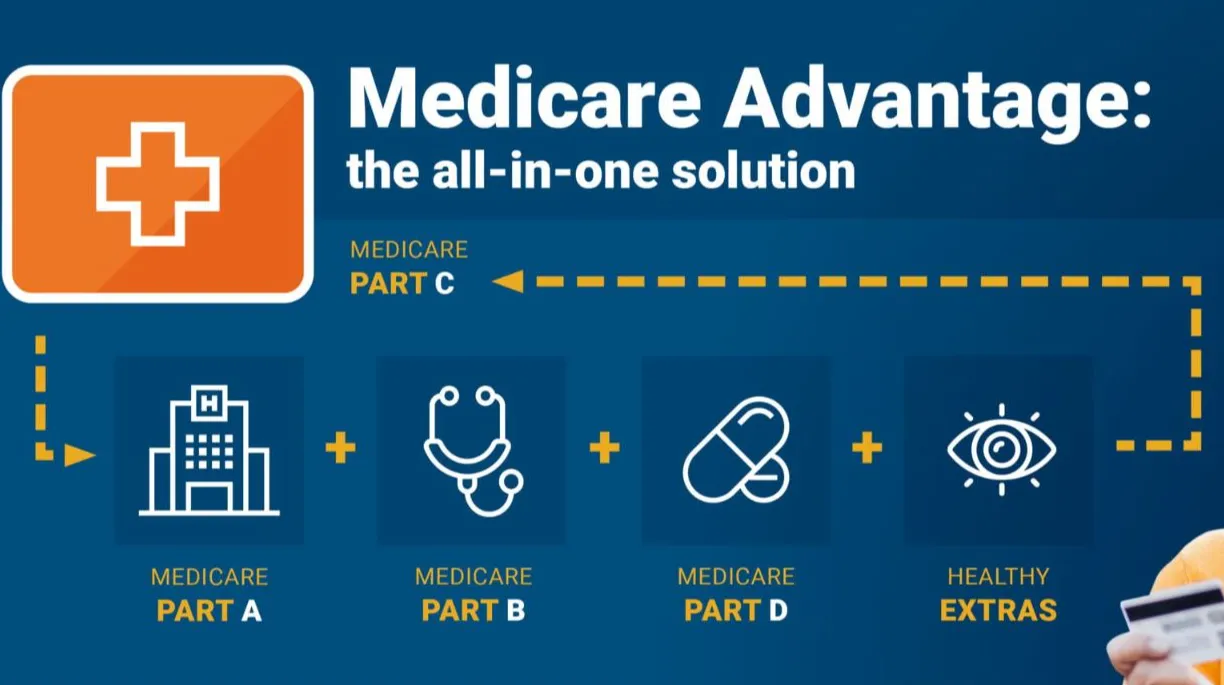

Medicare Advantage Plans function as offered by independent Insurance providers that partner with Medicare to provide Part A as well as Part B coverage in one combined format. In contrast to Original Medicare, Medicare Advantage Plans often feature additional benefits such as drug coverage, oral health care, eye care services, & wellness programs. These Medicare Advantage Plans function within specific geographic boundaries, making geography a critical consideration during review.

How Medicare Advantage Plans Differ From Traditional Medicare

Original Medicare provides open medical professional access, while Medicare Advantage Plans generally use managed care networks like HMOs with PPOs. Medicare Advantage Plans often involve provider referrals plus network-based facilities, but they commonly offset those restrictions with structured out-of-pocket amounts. For many enrollees, Medicare Advantage Plans offer a balance between cost control not to mention enhanced benefits that Traditional Medicare alone does not deliver.

Which individuals Should Evaluate Medicare Advantage Plans

Medicare Advantage Plans attract individuals looking for organized care not to mention potential expense reductions under a single plan structure. Older adults managing chronic medical issues commonly select Medicare Advantage Plans because connected treatment structures streamline ongoing care. Medicare Advantage Plans can additionally appeal to people who want packaged coverage options without managing multiple additional policies.

Qualification Requirements for Medicare Advantage Plans

To qualify for Medicare Advantage Plans, participation in Medicare Part A together with Part B must be completed. Medicare Advantage Plans are available to most individuals aged 65 as well as older, as well as under-sixty-five people with qualifying disabilities. Participation in Medicare Advantage Plans depends on residence within a plan’s coverage region with timing aligned with authorized enrollment periods.

When to Enroll in Medicare Advantage Plans

Scheduling has a vital role when joining Medicare Advantage Plans. The First-time sign-up window surrounds your Medicare eligibility date in addition to enables initial choice of Medicare Advantage Plans. Skipping this period does not remove eligibility, but it often change future options for Medicare Advantage Plans later in the calendar cycle.

Yearly & Qualifying Enrollment Periods

Every fall, the Yearly enrollment window permits individuals to change, remove, and/or add Medicare Advantage Plans. Qualifying enrollment windows become available when qualifying events occur, such as moving and/or loss of coverage, enabling adjustments to Medicare Advantage Plans beyond the typical timeline. Understanding these periods helps ensure Medicare Advantage Plans remain available when situations shift.

How to Review Medicare Advantage Plans Effectively

Comparing Medicare Advantage Plans requires focus to more than recurring payments alone. Medicare Advantage Plans vary by network structures, out-of-pocket maximums, drug lists, plus benefit guidelines. A careful assessment of Medicare Advantage Plans helps aligning medical priorities with plan structures.

Expenses, Benefits, plus Network Networks

Monthly expenses, copayments, as well as annual limits all define the overall value of Medicare Advantage Plans. Some Medicare Advantage Plans include low premiums but higher out-of-pocket expenses, while alternative options focus on stable spending. Doctor availability also changes, so making it essential to verify that chosen providers participate in the Medicare Advantage Plans under consideration.

Drug Coverage and also Additional Benefits

A large number of Medicare Advantage Plans offer Part D drug coverage, easing prescription handling. Beyond prescriptions, Medicare Advantage Plans may include fitness programs, ride services, with over-the-counter allowances. Assessing these elements helps ensure Medicare Advantage Plans match with daily medical priorities.

Enrolling in Medicare Advantage Plans

Enrollment in Medicare Advantage Plans can occur digitally, by phone, along with through licensed Insurance Agents. Medicare Advantage Plans need correct individual information plus verification of qualification before activation. Finalizing enrollment carefully prevents delays even unexpected benefit interruptions within Medicare Advantage Plans.

The Role of Authorized Insurance Agents

Authorized Insurance Agents help clarify coverage details along with outline differences among Medicare Advantage Plans. Consulting an expert can address network rules, coverage boundaries, in addition to expenses tied to Medicare Advantage Plans. Expert support commonly simplifies the selection process during enrollment.

Common Errors to Prevent With Medicare Advantage Plans

Missing provider networks ranks among the most issues when evaluating Medicare Advantage Plans. A separate challenge relates to focusing only on premiums without considering annual spending across Medicare Advantage Plans. Reviewing coverage materials closely helps prevent misunderstandings after sign-up.

Reevaluating Medicare Advantage Plans Every Coverage Year

Healthcare needs change, with Medicare Advantage Plans update each year as well. Reassessing Medicare Advantage Plans during annual enrollment enables updates when coverage, costs, and doctor access vary. Consistent review keeps Medicare Advantage Plans consistent with existing healthcare goals.

Reasons Medicare Advantage Plans Keep to Grow

Enrollment patterns show growing engagement in Medicare Advantage Plans across the country. PolicyNational.com Medicare Advantage Plan options Expanded coverage options, defined spending limits, also coordinated healthcare delivery help explain the growth of Medicare Advantage Plans. As offerings expand, educated evaluation becomes increasingly essential.

Long-Term Value of Medicare Advantage Plans

For many enrollees, Medicare Advantage Plans provide stability through connected coverage in addition to managed care. Medicare Advantage Plans can reduce management burden while encouraging preventive care. Identifying appropriate Medicare Advantage Plans establishes assurance throughout retirement years.

Compare and also Choose Medicare Advantage Plans Now

Taking the right step with Medicare Advantage Plans opens by reviewing local options plus confirming eligibility. Whether you are currently entering Medicare as well as revisiting current benefits, Medicare Advantage Plans provide versatile solutions created to support different medical priorities. Explore Medicare Advantage Plans today to secure a plan that aligns with both your medical needs & your financial goals.